is 646 a bad credit score|Is a 646 credit score good? : Manila A 646 credit score is considered "Fair" by the FICO mmodel. Falling within the "Fair" credit score range, specifically a score between 580 and 669, suggests that .

View deals from $182 per night, see photos and read reviews for the best Monte-Carlo hotels from travelers like you - then compare today's prices from up to 200 sites on .

is 646 a bad credit score,A 646 credit score is generally a fair score that may make it difficult to get approved for credit with favorable terms and rates. Learn how to understand your credit scores, build your credit and compare credit card offers with Credit Karma. Tingnan ang higit paIf you have fair credit scores, you might be wondering how to take your credit to the next level. Fair credit shows lenders that you have some experience using credit, but there’s still plenty of progress you can make in your credit journey. With patience and . Tingnan ang higit paIf you have credit scores in the fair range, you may face some challenges getting approved for loans and other credit products . Tingnan ang higit pa

There’s no single minimum credit score needed for a car loan. But generally speaking, credit scores in the fair range may limit your options to loans with higher rates and . Tingnan ang higit pa

The average credit score it takes to buy a house can vary widely depending on where you’re looking. With that said, it can be more . Tingnan ang higit pa A 646 credit score is considered "Fair" by the FICO mmodel. Falling within the "Fair" credit score range, specifically a score between 580 and 669, suggests that .is 646 a bad credit score Is a 646 credit score good? While your credit score is below average, it isn’t in the realm of “bad credit” and shouldn’t necessarily prevent you from getting certain types of loans. With your 646 . Your Credit Score. 300 850 ↓ 3 pt 646 Fair. Is 646 a good credit score? The FICO score range, which ranges from 300 to 850, is widely used by lenders and financial .A credit score of 646 falls into the “fair” range, which includes scores between 580 and 669—essentially, if you have a 646 credit score, it isn’t great, but it’s not awful either. . While it isn’t possible to identify the exact reason why your credit score is 646, common influences on Fair credit scores include fluctuating levels of total debt, .Having a credit score of 646 may put you in a delicate spot, but it's not a total brick wall when it comes to credit card approval. This score is perceived by numerous lenders as .

Is a 646 credit score good? Can I buy a home with a 646 credit score? If your credit score is a 646 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit . A score of 646 is considered "Fair". It's in your best interest to improve your credit scores as much as possible. Credit scores are important when qualifying for a loan .

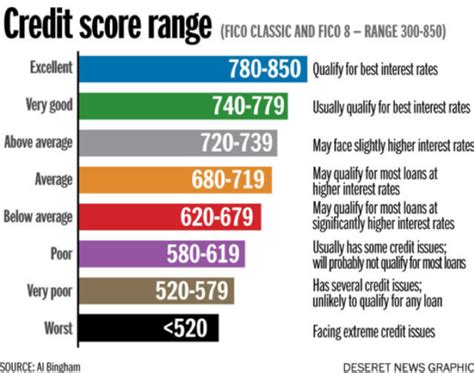

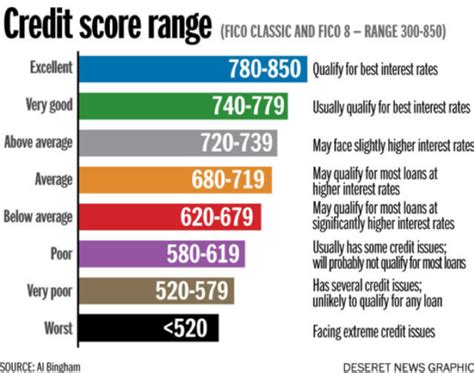

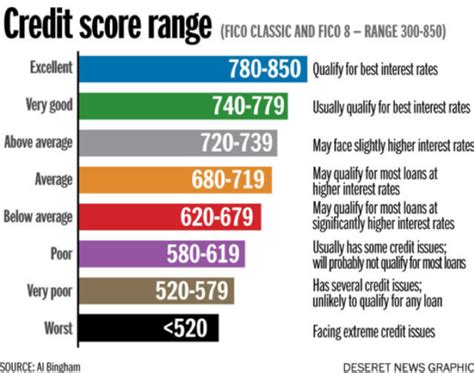

A credit score of 646 falls within the range of fair credit. While not classified as excellent, it's not a poor score either. Lenders typically view a score of 646 as an indication that the .is 646 a bad credit scoreThe FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score of 646 falls into the “fair” range, which includes scores between 580 and 669—essentially, if you have a 646 credit score, it isn’t great, but it’s not awful either. NerdWallet’s credit score bands, used for general guidance. Generally speaking, a good credit score is 690 to 719 in the commonly used 300-850 credit score range. Scores 720 and above are .

As you can see below, a 629 credit score is considered Fair. For context, the average credit score in America is 718. Credit Score. Credit Rating. % of population[1] 300 – 579. Poor. 16%. 580 – 669. A Fair-ranking credit score of 646 means that borrowers will face some challenges when attempting to qualify for a new loan, a new credit card, or a new line of credit. Credit scores of 646 can mean that even when approved, consumers will face increased interest rates and the possibility of higher fees. Consult the below details for . As you can see below, a 636 credit score is considered Fair. For context, the average credit score in America is 718. Credit Score. Credit Rating. % of population[1] 300 – 579. Poor. 16%. 580 – 669. There are four main credit bureaus in South Africa: Experian, TransUnion, Compuscan and XDS. At ClearScore, we show you your Experian credit score, which ranges from 0 to 740. Each credit bureau is sent information by lenders about the credit you have and how you manage it. Other information, such as court judgments against .

Below, you can check which credit score range you fall into, using estimates from Experian. Take note that the credit score lenders use varies, though 90% pull your FICO score. FICO Score. Very .

A 646 CIBIL Score is a below the average score credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications. Other lenders that specialize in 'subprime' lending, are happy to work with consumers whose scores fall in the Fair range, but they charge relatively high .

A FICO ® Score of 664 places you within a population of consumers whose credit may be seen as Fair. Your 664 FICO ® Score is lower than the average U.S. credit score.. 17% of all consumers have FICO ® Scores in the Fair range (580-669). Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously .The bad news about your FICO ® Score of 546 is that it's well below the average credit score of 714. The good news is that there's plenty of opportunity to increase your score. 91% of consumers have FICO ® Scores higher than 546. A smart way to begin building up a credit score is to obtain your FICO ® Score. Along with the score itself, you .

The FICO score range, which ranges from 300 to 850, is widely used by lenders and financial institutions as a measure of creditworthiness. As you can see below, a 635 credit score is considered Fair. For context, the average credit score in America is 718. Credit Score.

A score of 646 is considered "Fair". It's in your best interest to improve your credit scores as much as possible. Credit scores are important when qualifying for a loan or mortgage, applying for a job or apartment, and for obtaining professional certifications, licenses, and security clearances. If you improve your credit score by 74 points to . A bad credit score is usually below 630. Factors like missed payments can lead to low scores. Try simple strategies to build credit and get better financial deals.Highlights: A credit score is a three-digit number designed to represent the likelihood you will pay your bills on time. There are many different types of credit scores and scoring models. Higher credit scores generally result in more favorable credit terms. A credit score is a three-digit number, typically between 300 and 850, designed to .

A FICO ® Score of 696 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms. Additionally, because a 696 FICO ® Score is on the lower end of the Good range, you'll probably want to manage your score carefully . On the FICO ® Score ☉ 8 scale of 300 to 850, one of the credit scores lenders most frequently use, a bad credit score is one below 670. More specifically, a score between 580 and 669 is considered fair, and one between 300 and 579 is poor. The table below offers more detail on where scores fall.

675 credit score. Trustpilot. By CreditNinja. Modified on June 13, 2024. According to the FICO credit scoring model, a 675 credit score is good. Good credit indicates that a borrower is a safe credit risk. A good credit score is on the higher end of credit ranges. Good credit can help you secure decent installment loan or credit card .

A FICO ® Score of 676 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO ® Score, 714, falls within the Good range. A large number of U.S. lenders consider consumers with Good FICO ® Scores "acceptable" borrowers, which means they consider you eligible for a broad variety of credit products .

is 646 a bad credit score|Is a 646 credit score good?

PH0 · Is a 646 credit score good?

PH1 · Is a 646 Credit Score Good?

PH2 · Is 646 a good credit score?

PH3 · Is 646 a Good Credit Score?

PH4 · 646 Credit Score: What Does It Mean?

PH5 · 646 Credit Score: Is it Good or Bad? (Approval Odds)

PH6 · 646 Credit Score: Is 646 a good credit score?

PH7 · 646 Credit Score: Good Or Bad? And What Can I Get With A 646